That's because it has $135 million of interest payments due in June and a $208 million debt maturity in August. While the company has six months of liquidity, it will undoubtedly file before the summer. Meanwhile, in early May, credit rating agency S&P Global said that a bankruptcy filing from Chesapeake was a "virtual certainty" in the next few months.

In late April, for example, Reuters reported that Chesapeake was preparing to declare bankruptcy and had discussions with creditors on a $1 billion financing package that would help it navigate through the proceedings. That's because multiple news outlets have reported that Chesapeake Energy is precariously close to filing for bankruptcy protection. Those betting that Chesapeake can survive are playing a dangerous game. Why investors should steer clear of Chesapeake's stock That catalyst has the potential to fuel a big rally in the stock price, allowing speculators to make a quick profit. Thus, if prices rebound sharply, Chesapeake could be able to address this near-term maturity by selling assets as values recover. While the company has nearly $9 billion of debt outstanding, only $300 million of that matures this year.

#Market watch chesapeake energy Patch#

That's making it nearly impossible for the company to manage its debt.Ĭhesapeake bulls, however, believe that the company can make it through this rough patch if oil and gas prices rebound. First, oil and gas prices have tumbled because of a massive oversupply, which has eaten into Chesapeake's cash flow and weighed on the value of its assets.

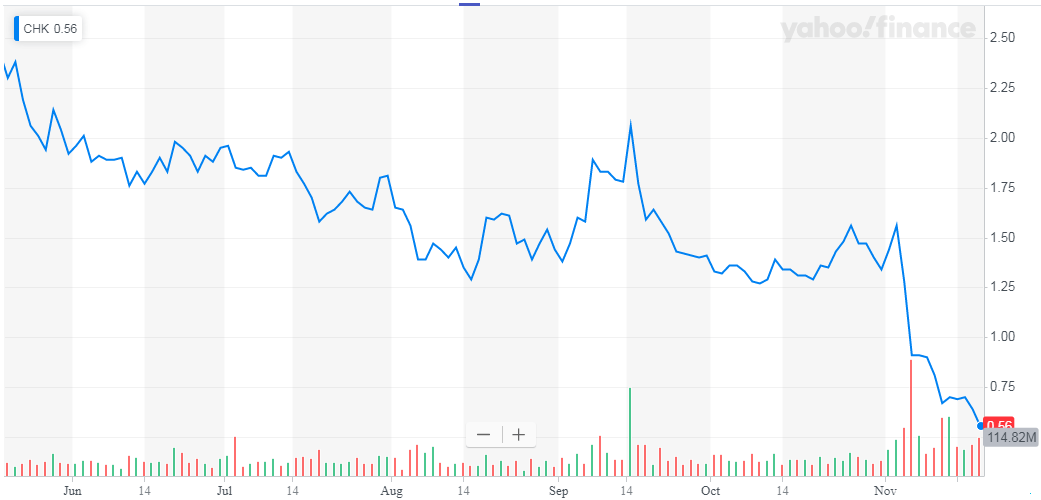

Shares of Chesapeake Energy have cratered 97% over the past year. Why speculators are scooping up Chesapeake's stock

0 kommentar(er)

0 kommentar(er)